汇款科普 | Why My Money "Lost" ?

Many users have reported that when sending dollars to bank accounts in non-US countries, they often receive less money than expected based on the confirmed exchange rate.

我们收到不少用户反馈,在向非美国地区的银行账户汇款美元时,发现到账金额比确认汇率时看到的金额要少。

What could be causing this?

这究竟是什么原因造成的呢?

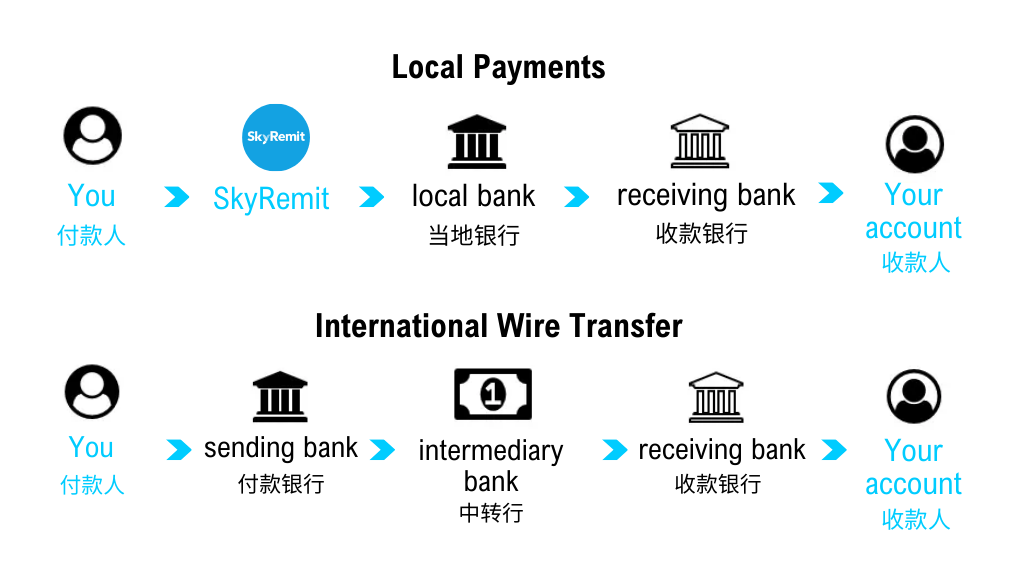

Firstly, it's important to note that SkyRemit primarily uses two channels for transfers:

首先要说明的是,SkyRemit 汇款主要使用两种方式:

Local Payments and international wire transfers

本地付款和国际电汇

【Fee Difference】

费用区别

Local payments only charge a 79RMB fixed fee per transaction, with no other intermediary bank fee.

本地付款只需支付每笔79元的手续费,无其他中转行费用。

International wire transfer involves multiple stages including the originating bank, intermediary bank, and receiving bank, potentially incurring additional fees, typically borne by the recipient (the user yourself).

国际电汇涉及出款行、中转行和收款行等多个环节,因此可能会产生一定的费用,而这些费用通常由收款人(即客户本人)承担。

Typically, the recipient will receive the payment minus the transfer charges. Therefore, the exact amount received in the end might be less than expected.

通常情况下,收款人收到的款项会扣除相应的转账费用。因此,最终到账的金额可能会少于预期的金额。

【Conditions of Channel】

渠道条件

Local Payments

本地付款

When sending money in the local currency to a specific location (e.g., sending GBP to the UK), SkyRemit partners with local banks to process the transaction, ensuring a faster processing time.

当您向某地汇款当地币种(例如向英国汇款GBP)时,SkyRemit 在当地的合作银行会负责处理交易,确保较快的到账速度。

International Wire Transfer

国际电汇

When sending a foreign currency to a specific location (e.g., sending USD to the UK), SkyRemit uses international wire transfer channels.

当您向某地汇款非本地币种(例如向英国汇款USD)时,SkyRemit 将采用国际电汇渠道。

US Domestic Wire Transfer

美国境内电汇

However, when sending dollars to the US, there might be some accounts that can only use domestic wire transfers instead of local payments, which may incur a fee of $12-$20.

然而,在向美国汇款美元时,部分账户只能使用境内电汇,不能用本地付款渠道,这时银行会收取12-20美金的手续费。